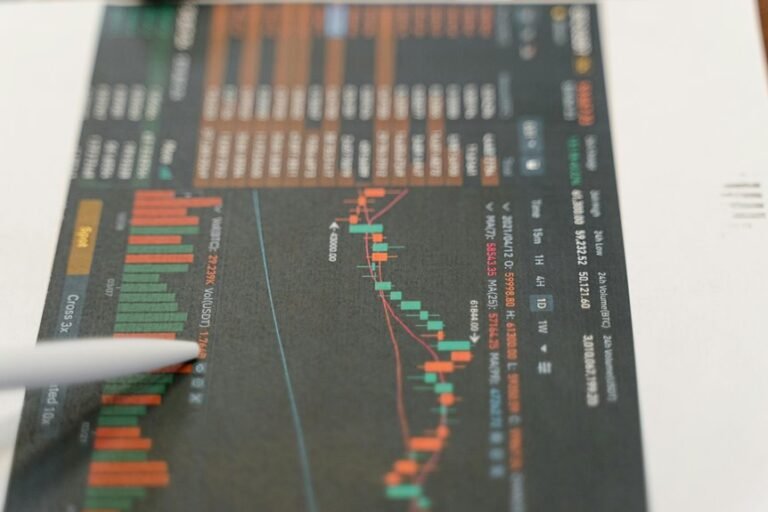

Financial Benchmark Overview for 9024531673, 649054781, 1138447549, 570020059, 379647000, 423038870

The financial benchmark overview for entities 9024531673, 649054781, 1138447549, 570020059, 379647000, and 423038870 provides a detailed analysis of their financial health. Key ratios indicate diverse levels of profitability and liquidity, suggesting different operational efficiencies. This overview raises questions regarding the implications of these financial metrics for strategic decision-making. Understanding these dynamics could reveal critical insights into market positioning and future growth trajectories. What implications might these findings hold for stakeholders?

Financial Performance Analysis of Identifiers

A comprehensive financial performance analysis of identifiers reveals critical insights into their operational effectiveness and market positioning.

Key financial ratios indicate profitability and liquidity, while revenue trends highlight growth trajectories and market demand.

Such analyses provide stakeholders with essential information that can guide strategic decisions, fostering an environment where operational transparency and financial health are prioritized, ultimately supporting a desire for autonomy in financial management.

Risk Assessment and Management Strategies

While organizations strive for financial performance, they must also prioritize risk assessment and management strategies to safeguard their assets and ensure long-term sustainability.

Effective risk management involves understanding risk tolerance and employing various mitigation techniques. By identifying potential threats and implementing appropriate responses, organizations can enhance their resilience, protect their financial standing, and ultimately foster an environment conducive to sustainable growth and innovation.

Strategic Planning Insights

Strategic planning serves as a crucial framework for organizations aiming to align their resources with long-term objectives, particularly in an evolving economic landscape.

Effective strategic forecasting enables firms to anticipate market changes, guiding informed decision-making.

Additionally, optimal resource allocation ensures that organizational capabilities are utilized efficiently, fostering agility and resilience in response to external challenges while enhancing overall competitiveness in the marketplace.

Implications for Investors and Stakeholders

Effective strategic planning not only shapes an organization’s internal capabilities but also has significant implications for investors and stakeholders.

By aligning with prevailing investment trends, companies can meet stakeholder expectations, fostering trust and engagement. This alignment enhances capital attraction and stability, ultimately benefiting all parties involved.

Investors are more likely to support organizations demonstrating foresight and adaptability in a rapidly changing financial landscape.

Conclusion

In conclusion, as these entities parade their financial metrics like peacocks flaunting their feathers, stakeholders may find themselves entranced by the colorful displays of profitability and liquidity. However, one must remember that beneath the vibrant surface lies the ever-looming specter of risk, diligently lurking in the shadows. Thus, while the numbers may sing a sweet song of financial health, a discerning investor must resist the allure and instead focus on the less glamorous reality of continuous monitoring and strategic vigilance.